Best Insurance Policies – Let’s dive into it

Introduction

Insurance is like a safety net, catching you when life throws its unexpected surprises your way. It protects you, your family, and your assets from potential financial loss, giving you peace of mind. With the multitude of options available, it can be overwhelming to figure out which ones are truly essential. That’s why we’ve narrowed down the top 5 best insurance policies that everyone should consider having.

Why is Insurance Important?

Insurance acts as a financial safeguard, ensuring that you don’t have to bear the full brunt of sudden expenses, whether it’s a medical emergency, car accident, or unexpected disability. It’s not just about protecting yourself but also about ensuring the well-being of those you care about.

Understanding the Different Types of Insurance

From health to home, and car to life, each type of insurance serves a unique purpose. Depending on your needs, lifestyle, and financial goals, the right mix of insurance policies can make all the difference. Let’s dive into the must-have policies.

1. Health Insurance

Why Health Insurance is a Priority

Healthcare costs can be astronomical, and without adequate coverage, a single hospital visit can set you back thousands of dollars. Health insurance helps cover medical expenses, from routine check-ups to more serious procedures, ensuring you get the care you need without financial strain.

Key Features to Look for in a Health Insurance Plan

When choosing a health insurance plan, consider factors like:

- Network Coverage: Check if your preferred hospitals and doctors are covered.

- Deductibles: Know how much you’ll need to pay out-of-pocket before insurance kicks in.

- Co-payments: Understand the percentage you’ll have to pay per service.

- Prescription Coverage: Ensure your medications are part of the plan.

Popular Health Insurance Providers

Top health insurance providers include:

- UnitedHealthcare

- Blue Cross Blue Shield

- Cigna

- Kaiser Permanente

2. Life Insurance

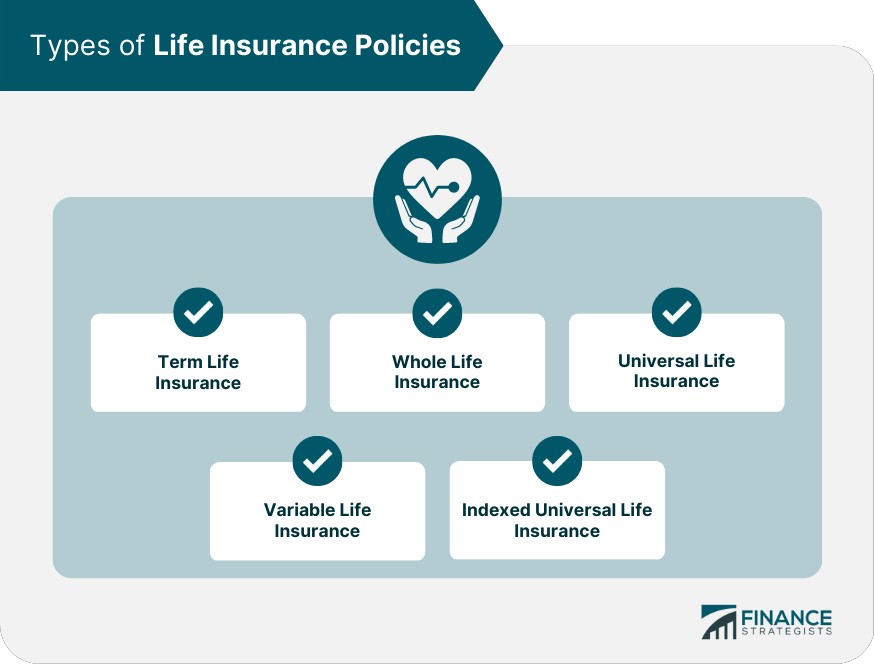

Types of Life Insurance Policies

Life insurance is crucial, especially if you have dependents. There are different types of policies to consider:

Term Life Insurance

Provides coverage for a set number of years (e.g., 10, 20, 30 years). It’s often more affordable and straightforward.

Whole Life Insurance

Covers you for your entire lifetime, accumulating cash value that can be borrowed against in the future.

Universal Life Insurance

Offers flexible premiums and coverage, with a cash value component that grows based on market performance.

Benefits of Having Life Insurance

Life insurance ensures that your loved ones are financially protected in case of your untimely demise. It can cover funeral costs, outstanding debts, and even future expenses like college tuition for your children.

Best Life Insurance Companies

Some of the best companies to consider are:

- Northwestern Mutual

- New York Life

- State Farm

- Guardian Life

3. Auto Insurance

The Necessity of Auto Insurance

Auto insurance is not only legally required in most places but also essential to protect you against financial loss if you’re involved in an accident. It covers repairs, medical expenses, and liability if you’re responsible for the damage.

Different Coverage Options Available

There are various types of auto insurance coverage:

Liability Coverage

Covers damages to other people’s property and injuries if you’re at fault.

Collision Coverage

Covers damage to your own car from accidents, regardless of fault.

Comprehensive Coverage

Covers non-accident-related damages, such as theft, vandalism, or natural disasters.

Choosing the Right Auto Insurance Plan

The right plan depends on your car’s value, driving habits, and budget. Compare multiple quotes and always consider the deductibles and limits offered.

Top Auto Insurance Companies to Consider

Leading auto insurance providers include:

- Geico

- Progressive

- State Farm

- Allstate

4. Homeowners Insurance

Protecting Your Biggest Investment

For many, a home is their most significant investment. Homeowners insurance protects it from damage or loss due to events like fires, storms, and theft.

Types of Coverage Included in Homeowners Insurance

Homeowners insurance typically includes:

Structural Damage

Covers damage to the house itself and any attached structures.

Personal Property

Protects personal items like furniture, electronics, and clothing.

Liability Protection

Covers legal fees if someone is injured on your property.

How to Select a Homeowners Insurance Policy

Look for policies that offer comprehensive coverage for your home’s value, include replacement cost options, and have good customer service reviews.

Recommended Homeowners Insurance Companies

Some reputable homeowners insurance companies are:

- Amica Mutual

- Liberty Mutual

- Allstate

- USAA (for military families)

5. Disability Insurance

What is Disability Insurance?

Disability insurance provides a portion of your income if you’re unable to work due to an illness or injury. It’s often overlooked but can be a lifesaver if you’re faced with an unexpected disability.

Short-Term vs. Long-Term Disability Insurance

- Short-Term Disability: Covers you for a few months, typically up to six months.

- Long-Term Disability: Kicks in after short-term coverage ends and can last for years or until retirement.

Why You Might Need Disability Insurance

Think of it as income protection. Without it, you may struggle to pay bills and maintain your lifestyle if you’re unable to work for an extended period.

Top Providers for Disability Insurance

Leading providers include:

- The Standard

- Guardian

- Breeze

- Principal Financial

How to Choose the Best Insurance Policy for You

Assessing Your Needs and Financial Situation

Before choosing any policy, assess your financial situation, current obligations, and long-term goals. Do you have dependents? A mortgage? These factors will help determine the coverage amounts and types you need.

Comparing Policies and Providers

Always compare quotes from multiple companies, review their coverage options, and consider customer satisfaction ratings. Don’t just go for the cheapest option; focus on the value offered.

Conclusion

Having the right mix of insurance policies can protect you from financial turmoil and provide peace of mind. Whether it’s health, life, auto, home, or disability insurance, being prepared is crucial.

FAQs

1. What is the most essential insurance policy to have?

Health insurance is often considered the most crucial, as medical expenses can be overwhelming without coverage.

2. Can I bundle different insurance policies together?

Yes, many companies offer discounts for bundling policies, like home and auto, which can save you money.

3. How can I reduce my insurance premiums?

You can reduce premiums by increasing your deductibles, maintaining a good credit score, and bundling multiple policies.

4. What factors affect insurance costs?

Factors include your age, location, claims history, and the amount of coverage you choose.

5. How often should I review my insurance policies?

It’s wise to review your policies annually or whenever a significant life change occurs, like marriage or purchasing a home.